During their last class, Professor Manolo Sanchez’s students heard from two local entrepreneurs who are working firsthand to try to disrupt traditional financial services. Save COO Adam Watts was among the invited entrepreneurs.

During his lecture, Watts spoke about our founding years, the latest product launches, the “Savetech” functionality, and growth goals to the MBA students of Professor Manolo Sanchez’s Digital Disruption in Finance course at Rice University.

Watts began the lecture by highlighting our Market Savings terms, which are currently 7.64% APY for a one-year term, 5.75% APY for a two-year term, and 9.29% APY for a five-year term.* Recently, Market Savings was featured alongside competitors’ rates on GOBankingRates where the Market Savings APY blows competitors’ rates out of the water.

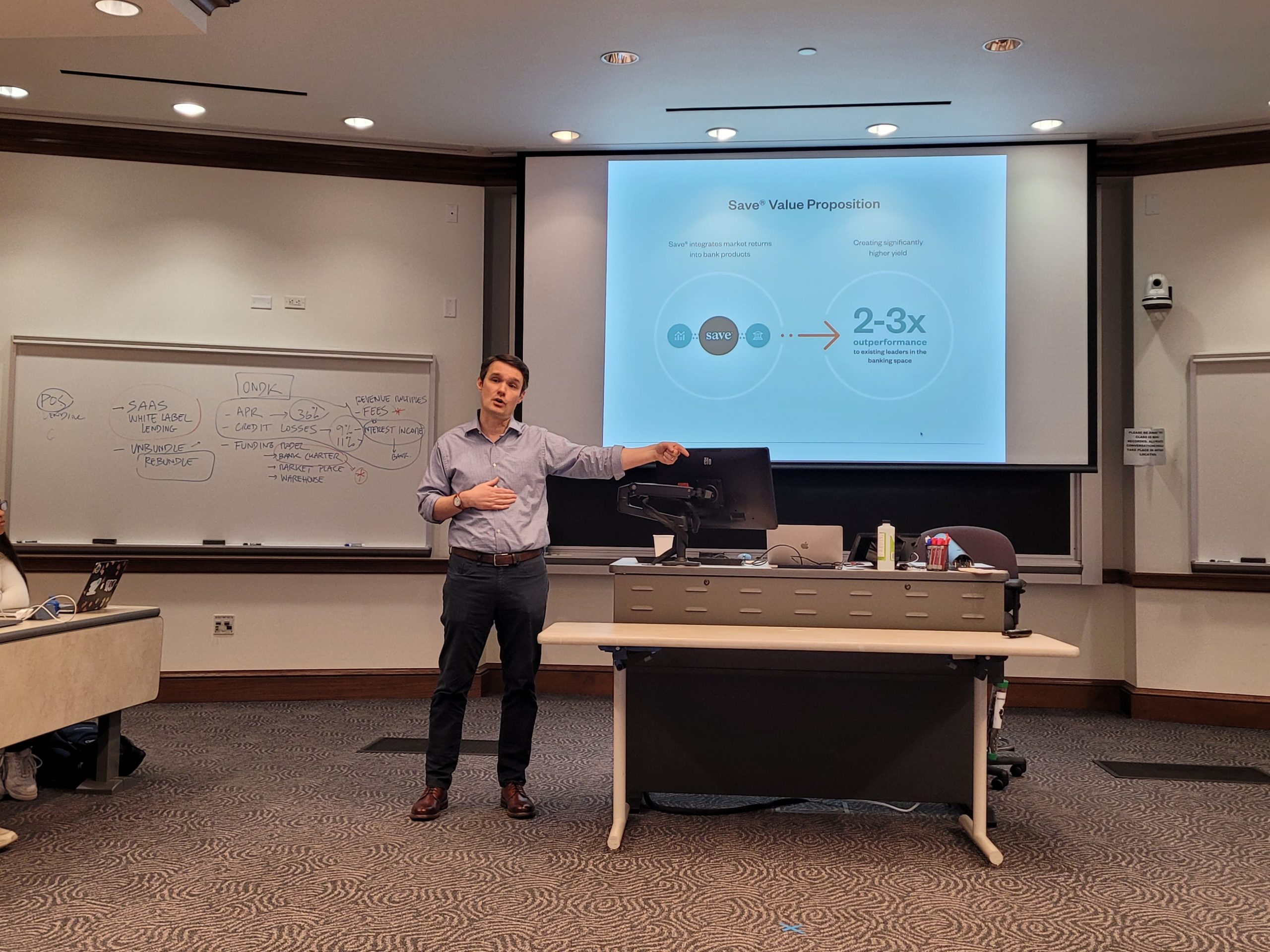

“Frequently, you will see our products outperform the leaders within that space by two to three times,” Watts said. “All while maintaining that great thing you love about your bank products where there is no risk to your cash, and you maintain FDIC insurance.”†

We’re able to achieve high APYs thanks to our partnerships. For Market Savings, we utilize two accounts; one deposit account with our partners at Webster Bank, N.A., Member FDIC, and one investment account with our partners at Apex Clearing Corporation. All cash deposited by customers for Market Savings is placed in an FDIC-insured bank account† and is not used to fund investments and is therefore not at risk of loss.

This allows all Market Savings deposits to be FDIC-insured† and invest equivalent portfolio investments on the behalf of Save customers at the same time. What we mean by equivalent portfolio investments is essentially taking the economic value of your deposits and purchasing securities on your behalf. Any equivalent investment is funded by Save partner banks. We do not fund it from customer accounts, and there is no requirement for customer outlay of their own capital.

The FDIC insurance† combined with higher APY* on your principal is motivated by our endless pursuit of looking after our customers. This practice extends into other aspects of our business, like our fee structure.

“We are the only wealth advisor – probably in the entire world – that doesn’t charge a fee unless you actually make money after our fees are deducted,” Watts said.

We are changing the investment world by doing something no other financial advisor is doing: If you don’t make money, we don’t make money.

Save’s management fee in the Market Savings program is 0.35% per year, but your portfolio has to earn more than 0.35% before we take our fee. This is our way of guaranteeing that your initial investment always stays intact while it grows.

The following is a breakdown of our fee structure:

| Portfolio earns less than 0.35% | Portfolio earns exactly 0.35% | Portfolio earns more than 0.35% |

| Save charges no fee | Save charges no fee | You collect all earnings above 0.35% |

| Your initial deposit stays intact | Your initial deposit stays intact | Your initial deposit stays intact |

“There are two key points with the Market Savings: One that we never put [our customers’] cash at risk,” Watts said during the lecture. “And then two because our fee structure is structured this way, there’s never going to be a scenario where we benefit, and the customer does not.”

After explaining how Market Savings works and a few business details, like the fee structure, to the students, the lecture took a more organic turn as students began to ask questions.

Overall, it was an honor to speak to the class and we look forward to future partnerships with Rice University.